In THIS NEW ISSUE, I start off with a discussion of the bond market and its fate.

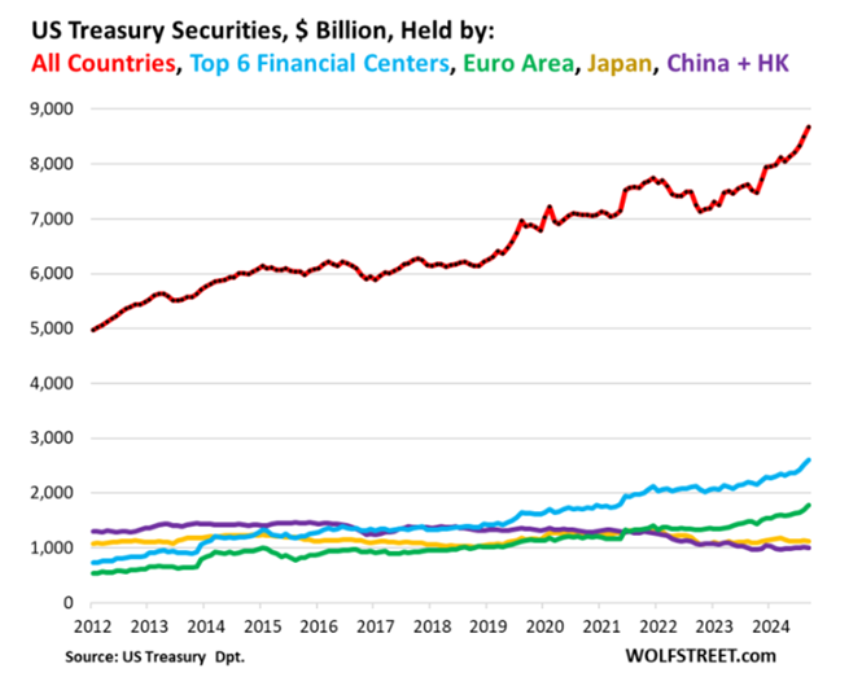

Long-term market yields have come down quite a bit of late as investors fret over recession probabilities and money otherwise rotates into Treasuries from overpriced stocks somewhat.

However, as I remind you, the downside for yields will stay limited due to still-substantial budget deficits with–again, with the alleged deficit hawks among Republicans (including the president) talking a better game than they play–$2 trillion or so more of debt likely to be added in this fiscal year.

Beyond all that–and also amid some “housekeeping” items–I have comments on the following holdings:

— Omineca Mining & Metals

— Frontier Lithium

— Seabridge Gold

— Royal Helium

–Uranium holdings and

— BacTech Environmental

When you join me, among the many things you’ll be entitled to is my “Members Handbook.” It crystallizes my approach to the markets…asset allocation recommendations… how I select individual companies…and a LOT more.