Greetings, Investors!

“US futures sink amid cratered hopes of 2025 rate cuts” is but one headline this morning as stock index futures weaken further. As I discussed among all those other subjects in the podcast I sent you this past weekend, at the least I expect 2025 to see some necessary repricing of stocks to better reflect the ever more clear “higher for longer” picture on both inflation and interest rates.

Beyond our existing allocations in both HDGE and SQQQ, I have waited to add further inverse exposure until 1. sentiment was changing sufficiently, 2. the technical picture was beginning to confirm a new trend and 3. events/announcements support that the early days of Trump 2.0 will not be helping things and may even add to the angst.

On 1. and 2. above, check. I suspect, all else being equal, a long overdue correction will see the broad market grind down (as measured by the S&P 500) to at least the 200 dma as you see below.

On 3., more signs than not (the odds against that “One, Big Beautiful Bill,” and early, aggressive tariff announcements at the top of the list) suggest that President Trump’s stock market health litmus test may not be doing him any favors early on. But that’s not a slam dunk; so as we should be adding to our inverse ETF positions, we’ll do it piecemeal.

For today:

1. ALL investors should take a position equal to 3% of their portfolio in the ProShares UltraPro Short S&P 500 ETF (NYSEArca-SPXU.)

2. More aggressive accounts should also take a position equal to 3% of a portfolio in the Direxion Daily Semiconductor Bear 3X Shares (NYSEArca-SOXS).

Both are started as a BUY.

____________________________________________________________

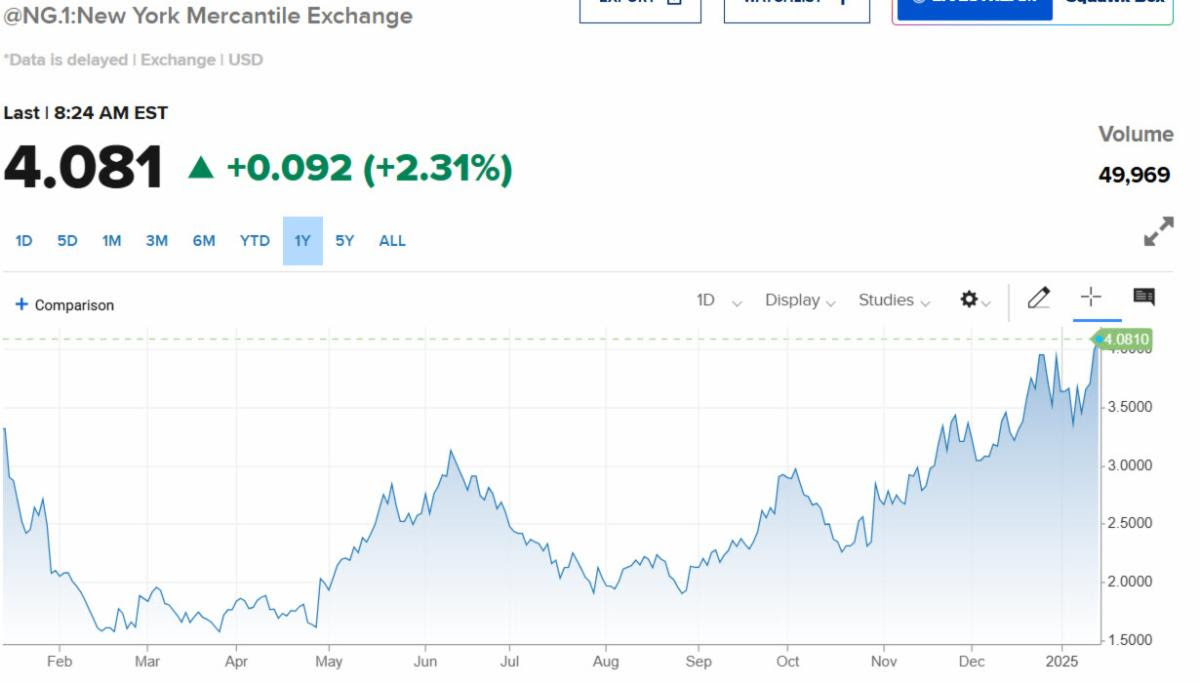

February natural gas popped sharply above the $4/mcf mark overnight but has been softening this morning, off earlier highs.

As also mentioned on the latest Your Money Today, I like natural gas a LOT. But, we’ve now had a more than doubling off the 30-year low price of several months ago. That’s been justified by the factors I’ve discussed; but my gut is telling me this notoriously fickle market–that can take back recent gains in the blink of an eye–needs to be treated with more care right now!

I believe that the added fuel in the nat gas price late last week now accounts pretty much for the view that colder weather will continue at least into late January. Also, exports of LNG have been strong, adding to demand for the commodity. Here, too, I suspect that some added bullishness comes via views that Trump 2.0 will be bullish for that latter factor especially.

Prudence dictates an exit strategy to preserve gains, however. And as I have been pondering this for a while this morning, I feel it’s best (and easiest) to simply SELL UNG and BOIL.

And I say that because, as alluded to, early momentum overnight is already fading; and a sharp bout of profit taking could materialize. I just don’t want to be too cute to get the last 5% of the move…and give back 20%.

So let’s lock in what are already respectable gains.

____________________________________________

Anavex Life Sciences has released THIS NEWS as this year’s big J.P. Morgan industry conference kicks off in San Francisco. As I discussed last issue, the company seems to be on track to begin selling blarcamesine in Europe before 2025 is over, augmented by ever more good news such as today’s (which, at the moment as I write this, is good for a slight pre-market gain.)

Here again, my gut and prudence suggest that–with the market having already taken AVXL up a lot–I want to once more ring the cash register here.

So, given that our position as of now remains about triple our original entry (and typical starting place for a stock) SELL HALF of your AVXL. This should still leave you with a larger than typical position for a single stock; appropriate as I think there’s still more to go.

All the best,

Chris Temple

Editor/Publisher

Monday a.m. — Jan. 13, 2025

Don’t forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/NatInvestor

* On Facebook at https://www.facebook.com/TheNationalInvestor

* On Linked In at https://www.linkedin.com/in/chris-temple-1a482020/

* On my You Tube channel, at https://www.youtube.com/c/ChrisTemple (MAKE SURE TO SUBSCRIBE!)

When you join me, among the many things you’ll be entitled to is my “Members Handbook.” It crystallizes my approach to the markets…asset allocation recommendations… how I select individual companies…and a LOT more.