Greetings, Investors. Among other things, I am looking as we transition to 2025 to:

1.Either double down on (several recommendations on that score where my existing recommendations are concerned that you’ll be reading about in the last regular issue for 2024 following this) or add great stories that are just too cheap to ignore and

2.Bolster further the kind of dividend-paying and value stocks I feel will be solid bets for 2025 and the transition in the markets I am expecting.

I have one of each below, starting with a new recommendation I have been getting to know better for some time:

Tectonic Metals, Inc.

TSXV-TECT; OTCQB-TETOF

Yesterday’s close — C$0.04/share, or US$0.028/share

There is no shortage of microcap junior gold explorers out there that–even in the case of a year where the gold price is up 27%–have been largely ignored. Most deserve that fate. A smaller number do not.

In that latter category, as I have come to be convinced, is Tectonic.

As you’ll be able to watch in a video interview upcoming I just did with Co-Founder and C.E.O. Tony Reda, if you look at all the key criteria you need to in vetting companies of this kind, Tectonic gets a positive grade on pretty much all of them:

–> My “Jockeys” theme — As you see below, Reda, his Co-Founder Eira Thomas and others have a solid track record of building value and monetizing it. Most notably in the same neighborhood, this included guiding the former Kaminak Gold in Yukon to a successful sale.

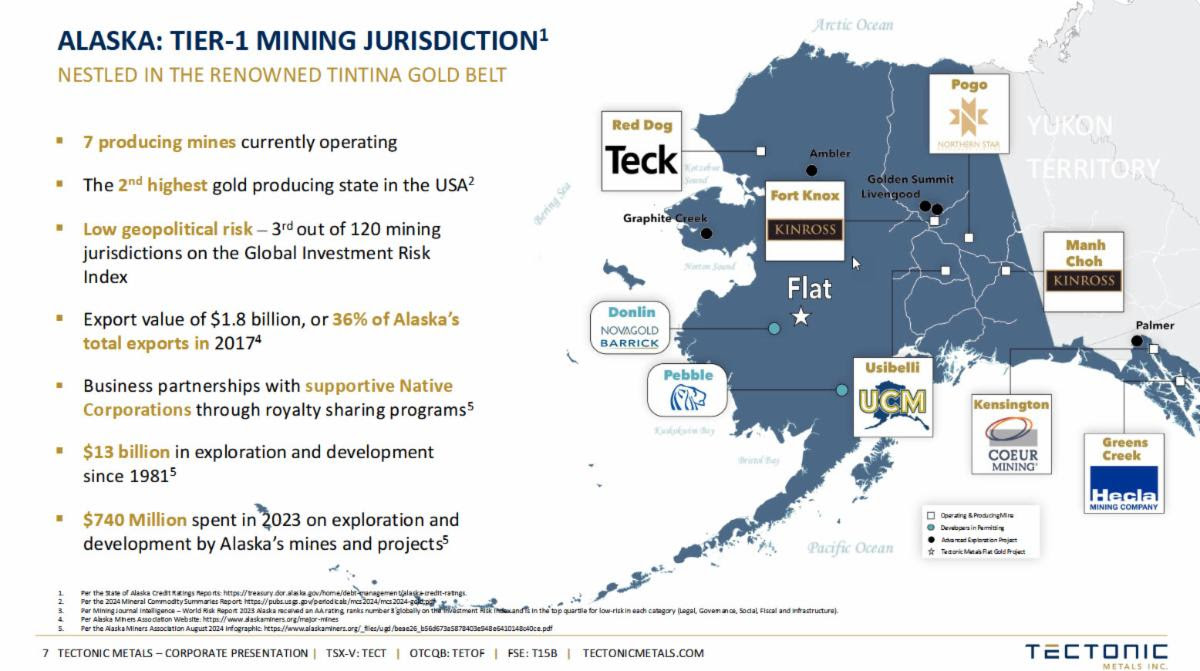

–> Location — It doesn’t get much better than having a property–the Flat Gold Project, with numerous targets that could one day each be an independent, economic resource–in such a major gold trend as the Tintina Gold Belt. Ditto, the friendly State of Alaska.

–> Potential Mine Dynamics — As you’ll learn at Tectonic Metals’ WEBSITE HERE, the attributes of a possible open pit operation at the main target (for now) Chicken Mountain, are very conducive to a low-cost, low-strip operation.

–> Metal content/metallurgy — Unlike, most notably, the huge Donlin Creek deposit to Tectonic’s southwest, the target material at Chicken Mountain 1. is not refractory ore and 2. Has recently demonstrated a high recovery rate (96% in one test and 91% in another) that would come via heap leaching a mix of oxide and non-oxide ore from Flat as was reported in September HERE.

–> Support/Ability to Raise $ — Well-known Crescat Capital is solidly behind Tectonic and its team and have become TECT’s largest shareholders at about 20% presently.

–> Native Alaskan Support and Direct, out-of-pocket investment — Tectonic’s second-largest individual shareholder is Doyon, Ltd., an Alaskan Native Regional Corporation which–Reda is both quick and proud to note–paid for its near-10% stake in the company.

Doyon’s involvement and support is part of a GREAT, fast-paced but succinct introductory video and overview of the company you should watch as a first matter RIGHT HERE. Click on “Flat Site Visit Video,” the first one pegged at the top of their YouTube page.

If there is a “negative” as some would see it on a typical investor’s (or, analyst’s) checklist it would be the share count. Fully-diluted, a bit over 500 million shares are outstanding; about 175 million are in the float (which, at least, makes for decent liquidity on an average day.)

Reda was very particular in explaining to me that his company’s strategy–especially sitting on such a potentially substantial Tier One Asset–is to raise the money now to do the work while he has willing partners and especially given that he’s much closer to fleshing out a more definable mine as time has gone on. I get it.

Tectonic is started as a BUY and added to my list of Speculative-rated companies.

____________________________________________

Next, I’m revisiting an “oldie” we’ve made a couple successful moves into over the years; a company that could hardly be more different!:

The Kraft Heinz Company (NASD-KHC)

Yesterday’s close — $30.39 / P.E. — 10.10

Div. yield — 5.3%

I’ve been mulling this and, frankly, a few other oldies where I think the odds are of at least a modest double-digit total return over the next year or two, as value is re-embraced 1. in its own right and 2. as a long overdue “repricing” rolls through the broad market.

KHC’s chart alone argues for conservative investors taking positions now, as the price is near the bottom of a well-defined range over the last four or so years.

And if you take an especially close look at the below chart you will note that during the broad down year for stocks in 2022, KHC’s share price ROSE nicely on the year.

I am of a mind–as you’ll be hearing ever more in the coming days, on top of the several recent interviews, podcasts and such you’ve already received–that 2025 will carry similarities to 2022. The best values and sector stories can and will rise even as I see the major indices once more likely to drop similarly to what happened in 2022.

As for Kraft Heinz particularly, as you can read in a great research piece RIGHT HERE, the food giant has made up for flattish revenues, more or less, by boosting margins, free cash flow (some $2 billion in the first three quarters of the year), and comfortably paying a 5%+ dividend.

This, to me, demonstrates KHC’s successfully employing economies of scale and better marketing than most to overcome what still lingers of its own inflationary pressures.

Kraft-Heinz is added back as an “Accumulate” to my roster of Income-oriented holdings.

All the best,

Chris Temple

Editor/Publisher

Tuesday a.m. — December 31, 2024

Don’t forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/NatInvestor

* On Facebook at https://www.facebook.com/TheNationalInvestor

* On Linked In at https://www.linkedin.com/in/chris-temple-1a482020/

* On my You Tube channel, at https://www.youtube.com/c/ChrisTemple (MAKE SURE TO SUBSCRIBE!)

When you join me, among the many things you’ll be entitled to is my “Members Handbook.” It crystallizes my approach to the markets…asset allocation recommendations… how I select individual companies…and a LOT more.