Good morning Investors. For this weekend's Your Money Today, as I posted late Friday to you, I have a new video/audio version of one of my most popular (if occasionally caustic!) Special Reports ever. RIGHT HERE you'll find the latest jam-packed long-form episode on the theme, "This is Still NOT Your Father's Gold Market!"

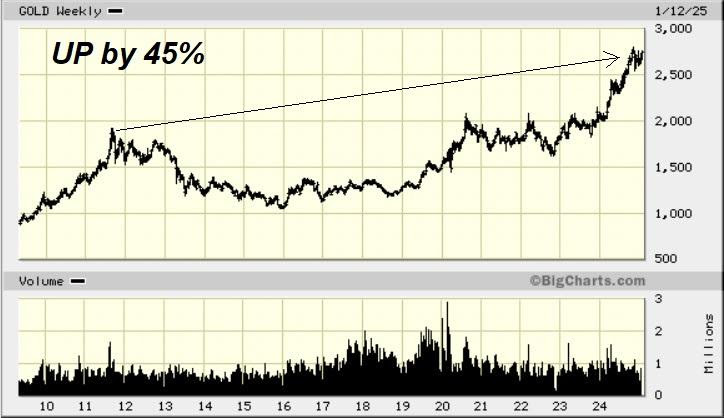

Once again in 2024, I begin, gold had a great year, with silver a respectably close second.

Yet most investors in precious metals continued to underperform even the metals, especially in part due to the typical exploration-related equity actually ending up DOWN on the year again.

Going forward, I explain, the sector--including precious metals-related equities--WILL have better days. BUT, I explain anew, you must look at the gold market, silver and related investments "clinically": WITHOUT preconceived notions and the veritable blind "religion" some preach, and with sound advice from legitimate experts on the space (as opposed to the carnival huckster / Pied Piper types incessantly trying to scare you into certain kinds of investments based on warnings of "Biden Bucks", dollar collapse and similar nonsense.)

Don't just walk away...but RUN from the kinds of charlatans that put out the kind of nonsense you see above and below!!

In addition to explaining the kinds of "experts," pitfalls and outright SCAMS (like Gold IRA's, peddled on many conservative platforms!!) to avoid, I give you a thorough explanation of the various ways precious metals markets, anchored by the gold market price itself, have changed over the years.

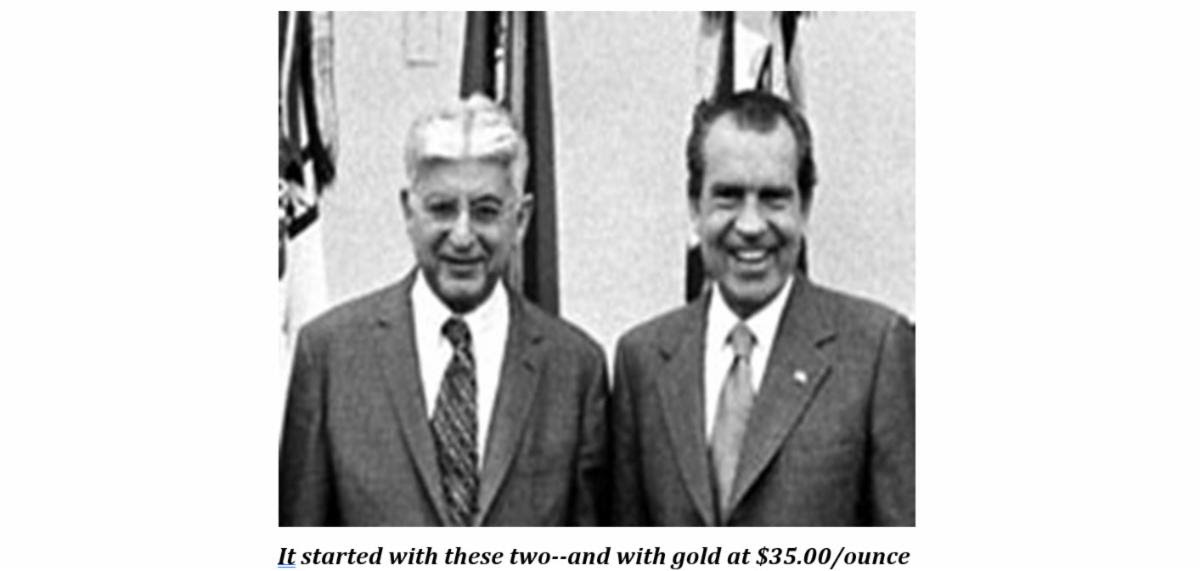

During the last half century-plus since the yellow metal became a free trading asset back in 1971, in fact, there have been three key "eras" if you will:

-- The initial burst higher in the 1970's thanks to the Nixon-Burns tag-team dollar debauching. This ultimately saw gold soar from $35/ounce to a brief, manic peak around $875/ounce.

-- Next, two decades "in the wilderness" during the 1980's-1990's, during which, at times, gold's price was "managed" in much the same manner as the DeBeers cartel managed diamond prices.

-- Third and most notably, I recap the pivotal (and wildly profitable for our Members at the time!) event in 1999 that changed the attitude of markets once more in favor of gold, and set the stage for the more than 10-fold price rise for the yellow metal since.

Along the way, though, investors have generally become much more fickle towards precious metals, often negating the more bullish impulse for gold especially led by the more aggressive net buying by central banks of recent years. Indeed, the last major peak for precious metals equities was way back in 2011.

I discuss the reasons why we have seen such underwhelming performances put in since those heady days...and what factors need to be in place to bring generalist investors back into precious metals--and even mining stocks--in a big way once more (it IS coming!!)

But that won't necessarily mean the rising tide to come will lift all boats. I discuss the "vetting" process you need to employ today in evaluating the best individual stories out there among both exploration and producing companies.

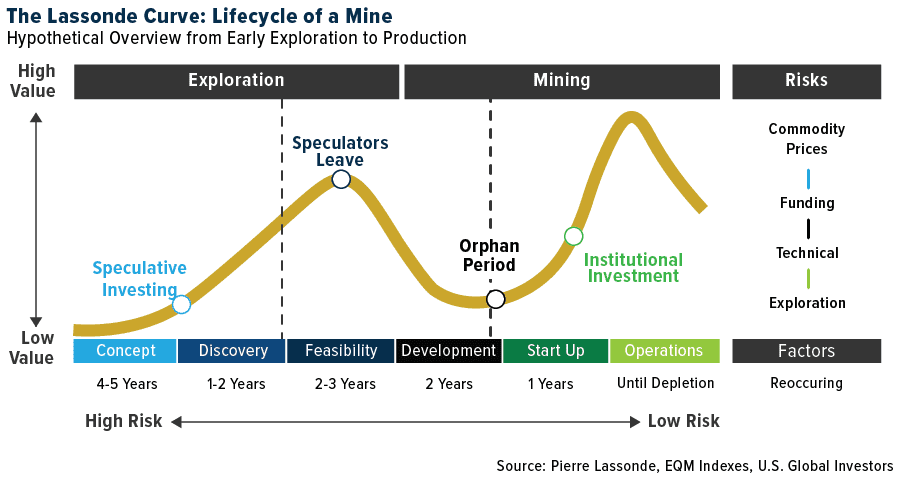

The "hoops" to jump through, in fact, have added at least one major, key ingredient to the well-known "Lassonde Curve" you see below.

I explain that for you, together with why it's important in that sense to evaluate exploration stories especially NOT on how juicy they appear to dyed in the wool gold bugs...but how they will appeal to generalist investors.

All that and MUCH MORE is in this episode...enjoy, learn and PROFIT from it!

And as always, if you have any comments or questions, let me know.

All the best,

Chris Temple

Editor/Publisher

Sunday morning, January 19, 2025

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/