The Fed's Next Act: But Judy Shelton Might not be Around for It

By Chris Temple – Editor/Publisher

The National Investor

https://www.nationalinvestor.com/

Congress can do no more than play confused, partisan politics with the central bank—and a new nominee—at a “Waterloo Moment” for the Fed, the economy and markets.

by Chris Temple -- Feb. 15, 2020

_________________________________________

“A double-minded man is unstable in all his ways”

* James 1:9 – KJV

“Whom the gods would destroy, they first make mad.”

* Euripedes

_________________________________________

I’m writing after having just watched the questions directed by members of the Senate Banking Committee to President Trump’s nominees to fill vacancies on the Federal Reserve’s Board of Governors. They are Dr. Judy Shelton and Dr. Christopher Waller. Waller is 110% Establishment; and a lead-pipe cinch to be confirmed.

An “outside the mainstream” Dr. Shelton, however, is not. While her nomination as of this writing is still in play—and President Trump is publicly supporting her and expressing optimism—I’ll be quite surprised if she makes it.

And perhaps that’s the way it should be. America today does not deserve a policy maker who actually can think.

“BORKED”

Not since the late summer, 1987 Senate confirmation hearing for Reagan Supreme Court nominee Robert Bork have I personally been so interested in such a key nominee to a post which—while not a lifetime one as at SCOTUS had Bork been confirmed—would nonetheless for Dr. Shelton likely run as long as a decade and a half.

Bork possessed the greatest legal mind—and with the greatest fidelity to the original intent of the Constitution of the United States of America, including in its giving only enumerated (not unlimited) powers to the federal government—of anyone nominated to the Supreme Court in the last century. Yet by the time the America of his day had so deteriorated in so many respects, Bork was anathema; a relic of a bygone time. Bork’s view of things was deemed outdated at best; “extremist” at worst.

His reasoned arguments on numerous positions were lost on many senators who are incapable of reasoned, meaningful discussion on much of anything. And in the instances where he backtracked and/or “repented” for views previously taken, it gained him nothing.

The most memorable instance (to me) of that latter deals very much with the subject at hand today. As his grilling proceeded, one senator asked him (I paraphrase) “You have expressed your view that, on many occasions, the Supreme Court has essentially legislated, going outside the original intent and authority of the Constitution to create new laws, rights, powers for the federal government, etc. that did not exist before. Will you please give this committee an example?”

Everybody was waiting for Bork to single out the infamous Roe v. Wade decision legalizing aborticide.

He did not.

Instead—without a moment’s hesitation, he singled out the Legal Tender Cases; two decisions rendered by the Supreme Court in 1871 that ratified the Lincoln Administration’s creation of paper money a decade earlier. The Constitution clearly, in his mind, allows for no such thing; and—as I was sitting in my living room watching the hearing with a dear, late mentor of mine who himself was a great historian and an expert on monetary issues—Bork eloquently explained why.

Yet—in a pointless attempt to assure the esteemed solons (BARF!) of the Senate he would not upset things—he quickly added that he would never think to vote to overrule the Legal Tender Cases in the event a new case on such issues properly came before the Court.

It didn’t matter.

SHELTON’S “EXTREMISM”

As was the case with Bork, Shelton was forced during this recent hearing (fellow nominee Waller was quickly rendered a wallflower; everyone need to get their shots in at her) to alternately deny, explain, rationalize or promise penance for numerous past pronouncements on a host of issues. Space here does not allow for a more complete recap, but here are a few key thoughts:

Gold -- It’s a measure of just how far gone things are that most Republican senators took issue with Shelton’s past embrace of gold or a “gold standard.” Even they for the most part have long since abandoned any pretense for supporting truly sound money; they endorse the G.O.P. game plan of borrow and spend—running up trillions in debt—while castigating the Democrat Party’s “socialist” tax and spend platform. And as with Bork’s softening some of his tone a generation ago to no avail, Shelton’s explanation of her views on gold—and assurance that such past episodes in American history when gold mattered were merely instructive for today—counted for little, if anything.

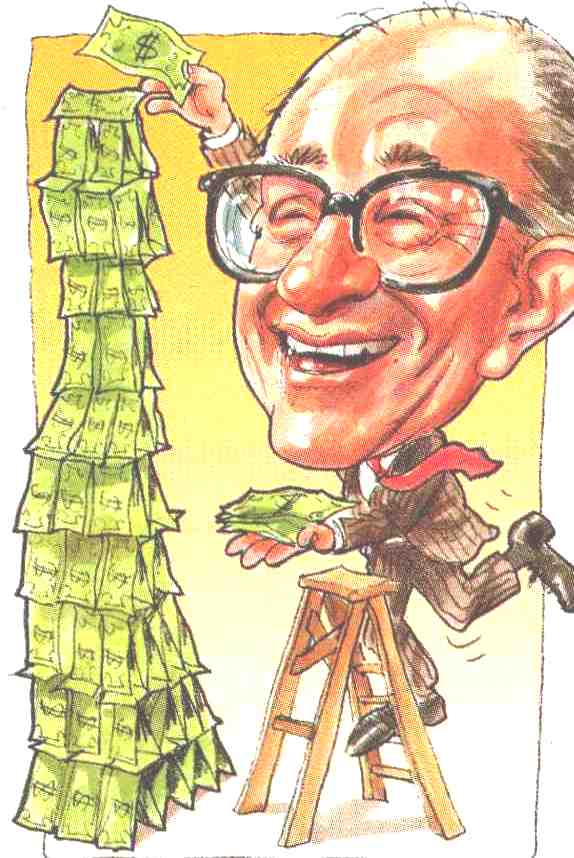

Among the more comical things about this, by the way, is that few even now (certainly among Republicans) have much bad to say about former Fed Chairman Alan Greenspan, a.k.a. “The Maestro.” His bona fides as a gold bug prior to working for Republican administrations and then the Federal Reserve were even more solid than Shelton’s. Yet that did not stop him from—once at the wheel—becoming the single-most destructive policymaker in American history; unleashing unregulated derivatives, newfangled securitization schemes and layers of debt on top of debt.

AND under his watch, incidentally, came the ONLY demonstrable episode I have personally ever seen where the Fed directly acted to meaningfully suppress the price of gold. (For the history of that, check out https://www.nationalinvestor.com/1490/gold-manipulation-history-lesson-feb-20-2018-issue/ and https://www.nationalinvestor.com/1482/now-gold-suppression/.

Shelton has ZERO desire or intent to change the status quo in this regard. But the “Borking” process isn’t concerned with such facts.

E-Z Money -- Indeed, Shelton has increasingly been articulating more creative reasons why the Federal Reserve should be even more accommodative today than it has been! For most of the double minded Republican senators, though, this caused their brains to half explode; now she’s for cheap money? And as for the Democrat nitwits, all this change of heart meant to them was that she is merely a pawn of the hated occupant of the Oval Office, whose constant carping about the Fed not being easy enough—and allowing a too-strong dollar—is irritating just about everyone.

“Devaluing” the Dollar – And on the subject of the greenback, that Shelton is attempting to force a discussion on a subject even Fed Chairman Powell grudgingly admits from time to time—that the Federal Reserve is the de facto central bank of the world, given the world lives with a dollar standard globally—is perhaps the most needed discussion right now given our present landscape and circumstances. But here too, Republican senators even more than Democrat ones went after her for wanting to address the dollar’s LEGITIMATE custodianship in a world that today is not a level playing field.

She was most eloquent on this issue, as she has been for a while. But again, there is no room in ossified (and hyper-partisan) Washington, or perhaps even at the Fed itself, for someone bringing up hard truths and “out of the box” potential solutions to problems.

About all the senators of either party have the political will or the brain power to embrace, it seems, was the slavish and pablum-like response by Waller (on the gold issue) he gave on one of the relatively few occasions we heard from him:

“The fiat monetary system we have around the world works well as long as it is managed well by the central bank.”

You’re hired!

SHELTON AND WALLER, HOWEVER, WOULD LIKELY END UP IN THE SAME PLACE POLICY-WISE

Waller and Shelton, above. Two fresh nominees. Same “Inflate or Die” agenda. But in Dr. Shelton’s case, with so thoughtful a rationale behind it as to be doomed to failure?

The irony of all this is that the Fed as an institution is at a crossroads; and its bag of tricks to ameliorate any coming economic weakness or market shocks is admittedly nearly empty. At such a time—as I wrote last summer, when the president first voiced his desire for Waller and Shelton to fill those two empty chairs on the Fed’s Board of Governors— somebody has to come up with both the game plan and sales pitch for what comes next.

And perhaps it’s appropriate (as those two quotes at the beginning of this piece suggest) that a Dr. Judy Shelton is rejected. It matters not that—for the most part—the Dr. Shelton of 2020 would arguably be even more of a monetary “dove” perhaps than even Waller (who will be one also.) In her specific case she can at least ably explain WHY, notwithstanding her previously-held views to the contrary (for more on this, listen in on a podcast I did following the hearing that went into more detail: it’s at http://www.kereport.com/2020/02/13/judy-sheldon-has-some-good-ideas-for-the-fed-but-her-confirmation-hearing-is-not-going-smoothly/)

In the end, Democrat senators (who would be lionizing her had she been appointed by a Democrat president and expressed the SAME policy goals on interest rates and the dollar she is now) will oppose her for no other reason than that she is a Trump appointee. And in the case of some of the double-minded Republicans who may end up killing her nomination, do they really want us to believe that they are somehow for sound money? Give me a break.

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/