Good evening Investors! Just following the late August Kansas City Fed-hosted annual summer picnic in Jackson, Wyoming, I recapped Fed Chair "Joliet Jake" Powell's evolving messaging and what it portends with The Prospector News' Michael Fox.

In THAT DISCUSSION, I pointed out (among numerous other things) that the central bank will increasingly be deflecting blame for that "slow, dull ache" of The Great Stagflation from itself. Powell and Company realize that--precisely as during a couple key past such episodes, after asset bubbles were blown leading up to respective bear markets starting in 2000 and 2007 especially--their looming rate cuts are NOT going to change things materially for the economy.

I also necessarily spent some time on the ongoing "Japanification" of China. This is a little-discussed phenomenon in global markets that is already being felt especially via commodity pricing in numerous areas, as I have been discussing in The National Investor for our Members (and will be further expounding on in the coming days.)

This is all going to muddy up trade, global investment markets, the nascent bull market for basic commodities, the near-term viability of all this BRICS hoo-hah you've been hearing about (that a key subject to come in our "Road Map" discussion part 3, coming soon) and a LOT more.

This is where differences in how a Trump Administration...or a Harris one...will approach trade issues generally and China specifically WILL later determine a lot of things.

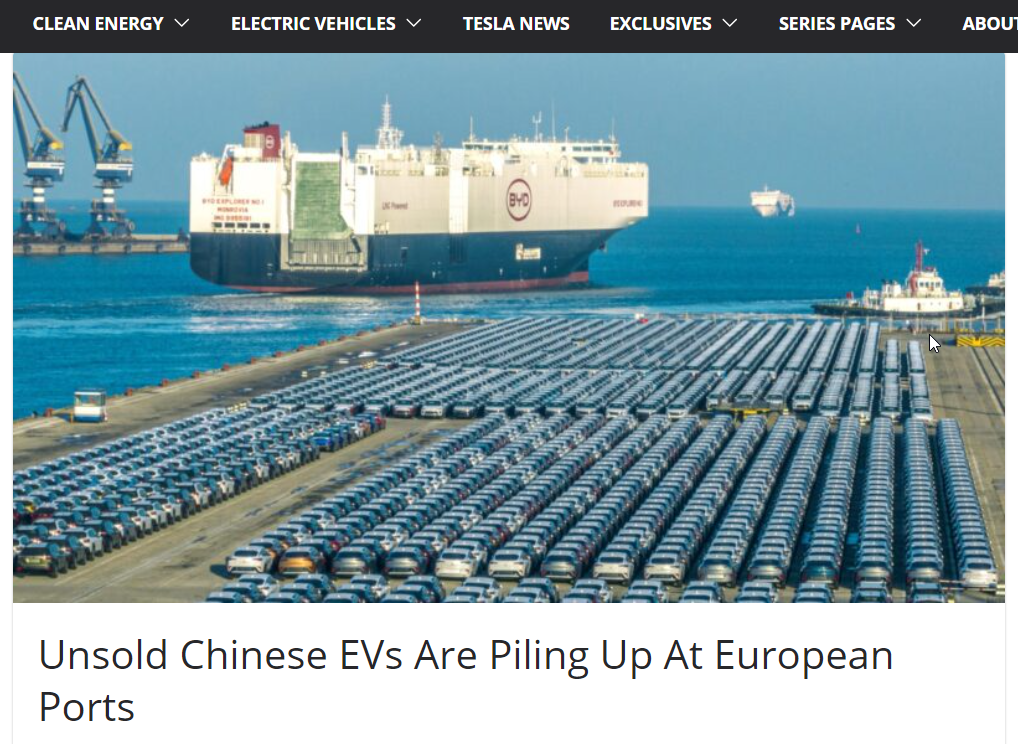

Either of these would-be presidents will be starting out confronting a greatly renewed propensity of China to dump cheap, excess goods on global markets in the largest volumes in a very long time. Perhaps ever.

And this dynamic alone is going to have to be reckoned with by us specifically when it comes to picking our portfolio spots in commodities/commodity equities going forward.

This, my friends, takes us into a broad subject that has been little discussed in this political season. When it is, it's with either juvenile/simplistic (Trump) or gibberish/uninformed (Harris) nonsense masquerading as substantive policy.

And that is: How is America going to effectively compete with China (primarily) -- and possibly now Russia more so -- as a combination of looming added shortages/embargoes of many commodities combine (in North America) with a regulatory and pricing structure that as a practical matter prohibits US today from doing much about this DISASTROUS economic and security crisis?

Recently, I informed you of our second "Road Map" video, which you can watch RIGHT HERE (or by clicking the above graphic.) In addition to the Fed's being set to start cutting short-term interest rates come Wednesday afternoon this week, I discussed what is already a "World War 3 over Commodities and Currencies" that is causing us to discard the playbooks of the past and ponder the unprecedented factors taking place right now.

If you haven't watched this one, do so. If you have, watch it again.

When it comes to commodities generally--particularly our own country's lack of most ANY coherent game plan to meet all our material and energy needs going forward--it's ridiculous that the current political season has given us virtually nothing of substance from either the Republican or Democrat Party standard-bearers on what they will specifically do to fix what needs to be fixed.

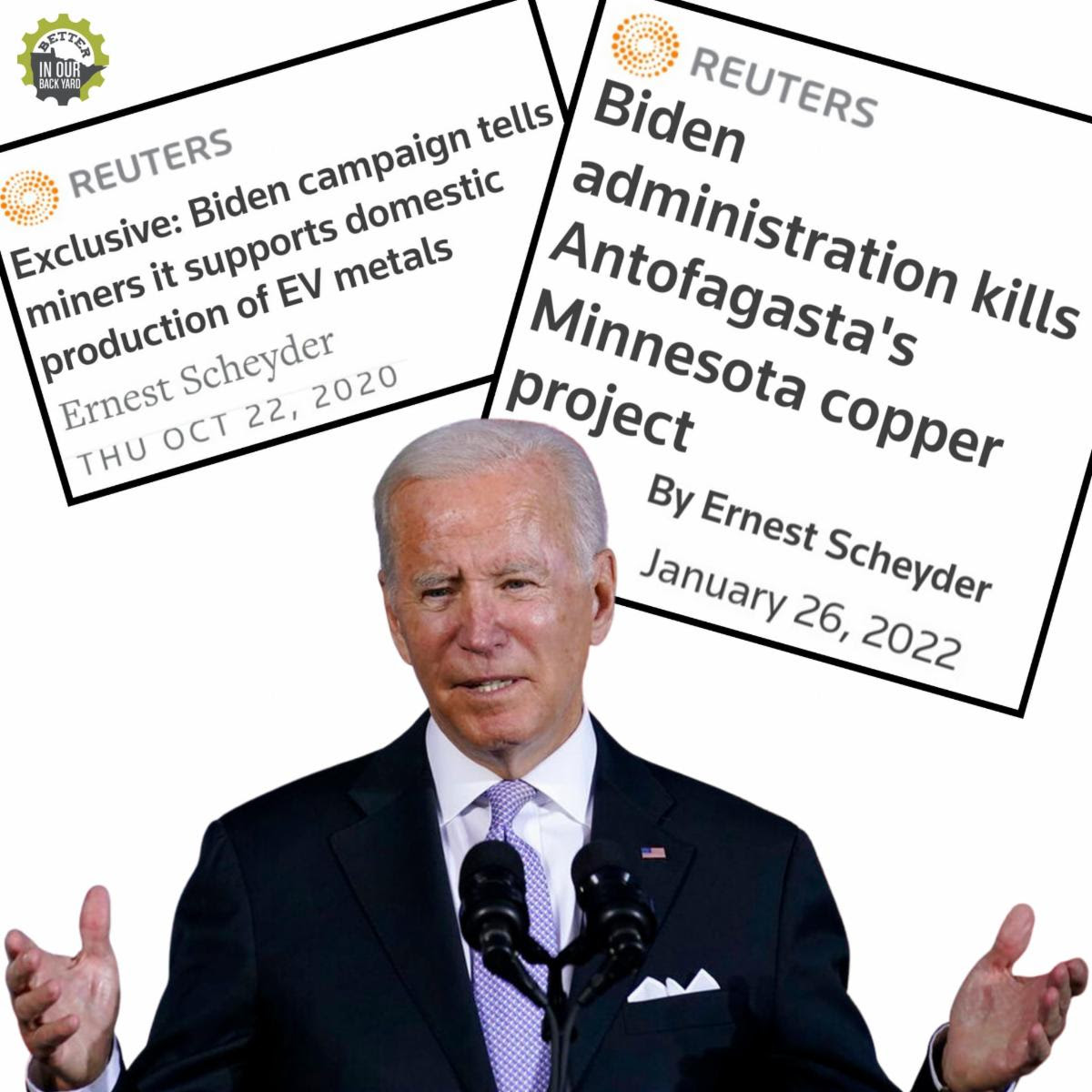

This is all the more a matter conspicuous by its absence (so far) given that the Minnesota Governor, Tim Walz, is the vice presidential candidate; yet has so far NEVER been asked his position on all the battery and other critical metals being kept in the ground in his own state, let alone in others.

Indeed, the average American knows FAR more about Walz's policy positions on feminine hygiene products than about this!

Perhaps during the upcoming vice presidential debate, we'll hear more abut copper, nickel, cobalt and more in Minnesota (and elsewhere) ... and not about tampons, or what Haitian migrants in Ohio have on the menu for this evening's supper.

For our own purposes, I'm in Walz's state again tomorrow for another great Better in Our Back Yard function just before I start the trek back home to soggy Florida mid-week.

Among other things, I'll be listening tomorrow evening to a presentation over dinner from Simon Charter of NewRange Copper Nickel as he gives us an update on the NorthMet Project. Work has continued there toward development despite the fact that the Biden Administration has done everything it can to continue slowing down development of this key American source of numerous metals.

And at the neighboring Twin Metals Project, Biden outright revoked its permit. This is after the president campaigning in 2019-2020 lauding this storied mining region's ability to help in the so-called "Green energy" transition.

It's increasingly incredible to me how fast time flies in life (indeed, it seems like I JUST got up north for the earlier BIOBY event I mentioned previously; now tomorrow's will be just ahead of my 2024 departure.) Thinking back on NorthMet and its former owner PolyMet (about a 20-bagger for us at one point many moons ago) it has now been a quarter of a century since I first visited that project.

Amazing.

And that these 25 years have gone by with NorthMet still hobbled...yet with the DIRE straits we are increasingly in when it comes to meeting our needs for so many commodities...speaks volumes.

So here's to hoping that the upcoming Vance-Walz debate will succeed where the vapid one between The Orange Wonder and Cacklin' Kamala failed: to give us more of a substantive discussion on these critical issues...and less of one on tampons, cats, etc.

_____________________________

In both a fresh discussion with Michael Fox and another new issue of the Members newsletter following, I'll be providing my usual post-mortem and then some as the Fed offers its first cut to the federal funds rate in 4 1/2 years.

As this past week ended, gold had set a new nominal all-time high and the stock market had erased pretty much all its September-beginning swoon. This was as bets increased in the fed funds futures market to an even chance of a 50 basis point cut come Wednesday. At the least, expectations are far higher than "toss-up" that the Fed's so-called dot plot will move in a decidedly more dovish direction from June's, with multiple more rate cuts in the offing over the next year or two.

Somewhat as I alluded to above where commodities specifically are concerned, this set of rate cuts set to start from the Fed will be writing its own history to a great extent. In some ways the outcomes will be as expected. In some, not so.

And unlike during any prior such episode, things are happening in the world that neither the Fed nor us as consumers/investors have ever had to consider.

Stay tuned...

All the best,

Chris Temple

Editor/Publisher

Sunday evening -- September 15, 2024

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/