By Chris Temple – Editor/Publisher

The National Investor

https://www.nationalinvestor.com/

(Sunday -- December 17, 2023)

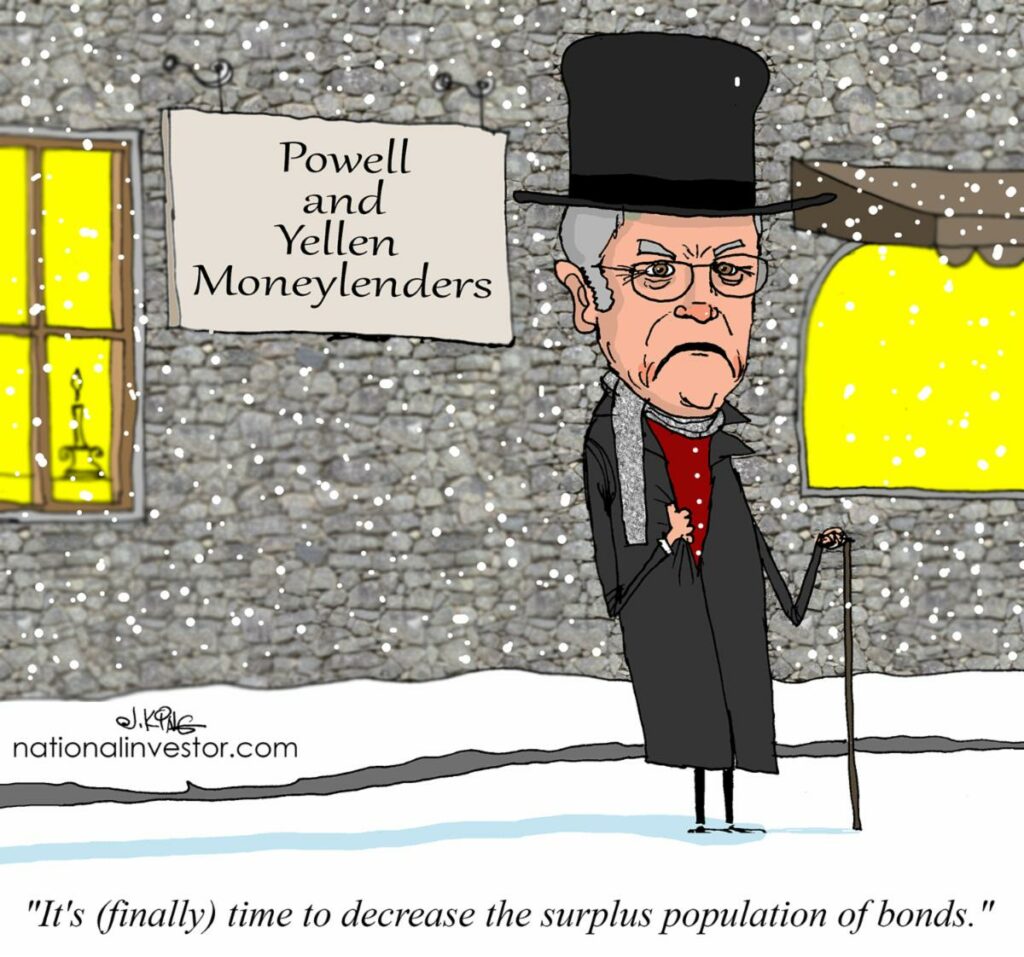

Since very belatedly starting to mop up the historically extreme oceans of new money/credit that he first unleashed from late 2019-early 2022, Fed Chair Jerome Powell was fairly consistently acting as the crotchety, "early" Ebenezer Scrooge from Dickens' A Christmas Carol.

But at this past Wednesday's F.O.M.C. meeting and following presser, Powell suddenly acted as Scrooge after visits by three ghosts changed him. You can almost see the former (?) Fire Marshall Jay dancing and babbling gleefully in his bed chamber when he woke up Wednesday full of good will and cheer; and if market reactions are to be vindicated, prepared again to shower markets any day now with more gifts.

Early yesterday, as some of you have already seen, The Prospector News' Mike Fox posted our discussion from Friday on the surprisingly "dovish" Fed meeting and implications; it's RIGHT HERE for your use.

As have others since Wednesday, we posed and discussed the question many have had: what does Powell see, or what does he know (or what did one of those spirits reveal about the future?) that caused him to so change his tune in under a month's time, as Sven Henrich outlines below?

I'll be discussing all this and more in the days ahead even beyond Mike's and my DISCUSSION, as we set up our theses, probabilities and somewhat revamped portfolios for the start of 2024. For now--notwithstanding N.Y. Fed President John Williams' after-the-fact attempt to play "bad cop" (or Bad Scrooge) on Friday--markets are going to remain of a mind that Printer is Coming.

As I explain in our conversation (and as Mike seconds on a few scores), I think the markets will be disappointed before we get too far into the New Year when inflation remains stubborn and--though they will now be loathe to raise rates any further--the Fed suggests it will still hold them at present levels longer than markets now expect (a first cut as early as March is the current 50-50 proposition in fed funds futures markets.)

But for now, we must increasingly ponder the possibility, as explained, of still more new highs for stocks ahead before the longer-term reality of The Great Stagflation sets in. . .and ahead of the REAL "pivot" still to come.

That event still ahead, as I explain, will galvanize The Great Stagflation, serve as one of the last ingredients needed to fuel the next sustainable move for precious metals and more.

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/