Today, we mark summer's unofficial end. I guess I am getting older, as this one flew by faster than any summer of my life! We'll be up north a bit longer still, but looking past that, I'll be weaving my way back home by mid-month (with possibly an impromptu gathering in the Chicagoland area on the way, during the latter part of the week of September 16.)

If that's in the cards you'll be hearing about it; but in the mean time, let me know if you'd like to visit on my way through if that does prove workable.

For today, I want to share with you THIS NEW VIDEO, the second in our "Road Map" series. In this one, I take us past the uncertainty still before us regarding the upcoming election and what policy outcomes, etc., we can't yet identify and instead discuss what we CAN plan on dealing with no matter the results.

For example, ever-soaring new deficits, indebtedness, and the ongoing stagflation that all brings will remain our lot in life.

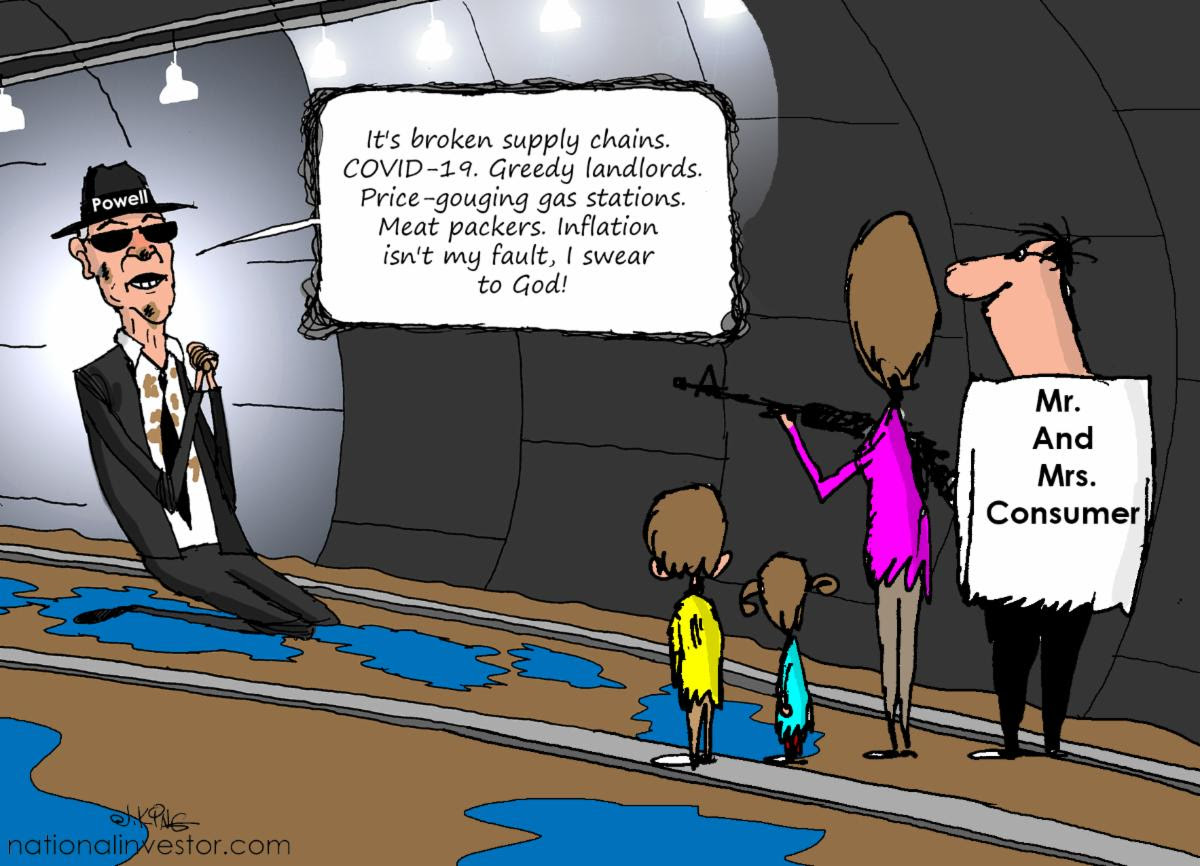

Indeed, as I kick off the discussion, Fed Chairman Powell was newly selling his "Joliet Jay" schtick at the recent Kansas City Fed-hosted summer picnic, setting us up for anyone who was listening to the central bank deflecting more blame from itself on inflation specifically.

I repeat what I have said many a time: The Fed cannot mathematically at this point bring us down to any legitimate sustainable 2% inflation target. Period, end of story.

And Powell knows it, which is why he is now (later than I thought he would, to be sure) arranging the Fed's own messaging to deflect blame from itself.

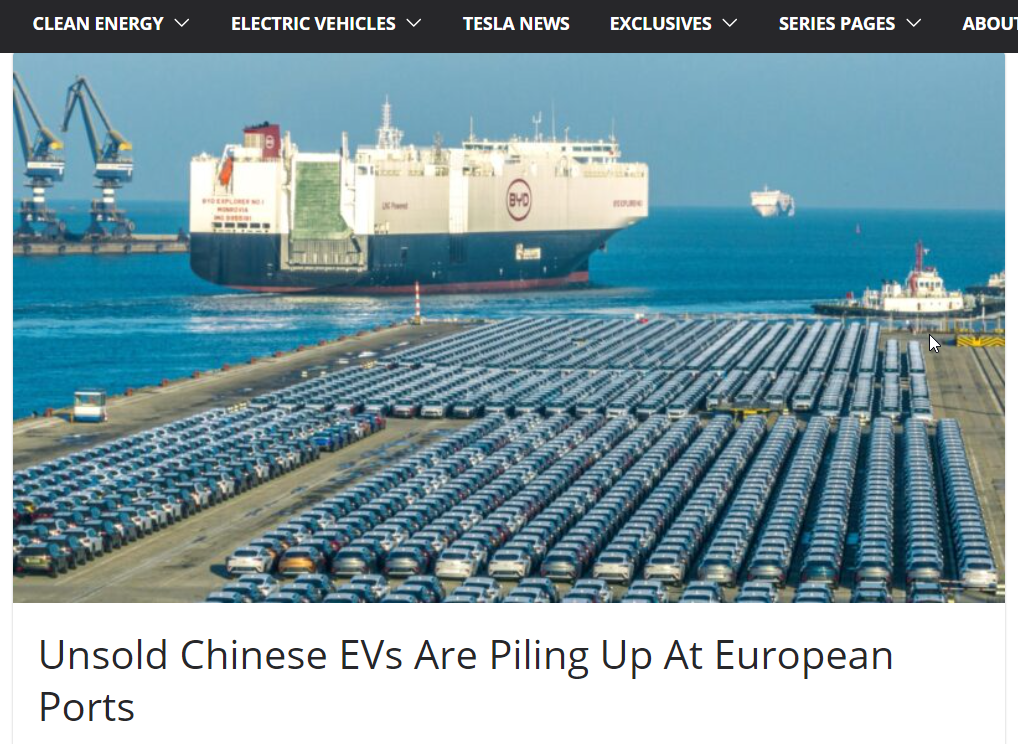

I also necessarily spend some time on the ongoing "Japanification" of China. This is going to muddy up trade, global investment markets, the nascent bull market for commodities, the near-term viability of all this BRICS stuff (that's a key subject to come in our Road Map discussion part 3, coming later this month) and a LOT more.

This is where differences in how a Trump Administration...or a Harris one...will approach trade issues generally and China specifically WILL later determine a lot of things.

But either of these people will be starting out confronting a greatly renewed propensity of China to dump cheap, excess goods on global markets in the largest volumes in a very long time. Perhaps ever.

And this dynamic alone is going to have to be reckoned with by us specifically when it comes to picking our spots in commodities going forward.

All the best,

Chris Temple

Editor/Publisher

Monday morning, Labor Day -- September 2, 2024

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/NatInvestor

* On Facebook at https://www.facebook.com/TheNationalInvestor

* On Linked In at https://www.linkedin.com/in/chris-temple-1a482020/

* On my You Tube channel, at https://www.youtube.com/c/ChrisTemple (MAKE SURE TO SUBSCRIBE!)

Looking Past the U.S. Election: Continuing Stagflation…Commodities…China…and More

Today, we mark summer's unofficial end. I guess I am getting older, as this one flew by faster than any summer of my life! We'll be up north a bit longer still, but looking past that, I'll be weaving my way back home by mid-month (with possibly an impromptu gathering in the Chicagoland area on the way, during the latter part of the week of September 16.)

If that's in the cards you'll be hearing about it; but in the mean time, let me know if you'd like to visit on my way through if that does prove workable.

For today, I want to share with you THIS NEW VIDEO, the second in our "Road Map" series. In this one, I take us past the uncertainty still before us regarding the upcoming election and what policy outcomes, etc., we can't yet identify and instead discuss what we CAN plan on dealing with no matter the results.

For example, ever-soaring new deficits, indebtedness, and the ongoing stagflation that all brings will remain our lot in life.

Indeed, as I kick off the discussion, Fed Chairman Powell was newly selling his "Joliet Jay" schtick at the recent Kansas City Fed-hosted summer picnic, setting us up for anyone who was listening to the central bank deflecting more blame from itself on inflation specifically.

I repeat what I have said many a time: The Fed cannot mathematically at this point bring us down to any legitimate sustainable 2% inflation target. Period, end of story.

And Powell knows it, which is why he is now (later than I thought he would, to be sure) arranging the Fed's own messaging to deflect blame from itself.

I also necessarily spend some time on the ongoing "Japanification" of China. This is going to muddy up trade, global investment markets, the nascent bull market for commodities, the near-term viability of all this BRICS stuff (that's a key subject to come in our Road Map discussion part 3, coming later this month) and a LOT more.

This is where differences in how a Trump Administration...or a Harris one...will approach trade issues generally and China specifically WILL later determine a lot of things.

But either of these people will be starting out confronting a greatly renewed propensity of China to dump cheap, excess goods on global markets in the largest volumes in a very long time. Perhaps ever.

And this dynamic alone is going to have to be reckoned with by us specifically when it comes to picking our spots in commodities going forward.

All the best,

Chris Temple

Editor/Publisher

Monday morning, Labor Day -- September 2, 2024

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/