Good morning, Investors. This past week, I joined my old friends Shad Marquitz and Cory Fleck at the K.E. Report again to -- this time -- discuss in some greater detail various commodities in the context of President Trump's real and threatened tariffs. Is President Trump Bluffing?

You can access this fairly compact (under 20 minutes!) but PACKED discussion RIGHT HERE.

I discuss the reasons why you must be extremely selective these days in your choice of commodity themes. And we discuss several specifically: ones that remain actionable for investors now and ones which we need to wait on for the most part.

Looming still, as we also discuss, are those tariffs that have not yet been put into effect. Indeed, now for the second time the president has started the drumroll for the imposition of some only to, at the last moment, suspend their enactment; this week, it was the so-called "reciprocal tariffs" that have now been pushed out to at least April 1.

As with those 25% across-the-board ones that were suspended in regard to Canadian and Mexican imports (10% for Canadian energy), Trump's seeming bluffing again had one clear immediate effect, at least: to cheer Wall Street and push stocks back to their highs.

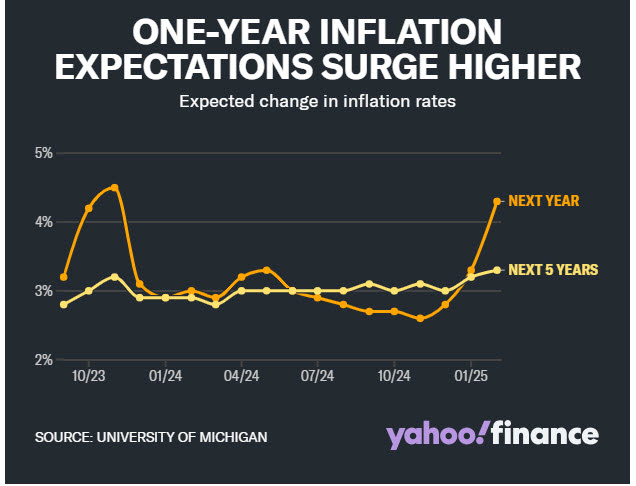

That was despite the fact that -- though Fed Chair Powell insisted otherwise again to Congress in his Humphrey-Hawkins testimony this past week -- inflation continues to rebound and move higher.

Fire Marshall Jay claims one thing...but American consumers are feeling and anticipating something quite different!

The tariff story might not stay as benign as all this, though, for long. But still, that this key subject/policy of Trump 2.0 is starting out at least "less bad" than initially feared has been a net positive for markets already out over their skis and susceptible to disappointment.

Shad, Cory and I discussed those areas of commodities/critical materials that are actually benefitting from tariffs, embargoes and such. You'll want to focus on these...and likewise, beware of most "battery" metals and even some broader industrial ones, as the full set of policy and economic ingredients needed for North American projects does not seem to be coming right away to help those others.

We also spent some time discussing the regrettable harm that Trump has done to relations between the U.S. and Canada specifically; especially on energy (where Trump has BADLY misunderstood and/or mischaracterized things; but at the same time has galvanized our neighbor to the North around the idea that Canada needs to embark on an emergency plan to find other customers for its energy!)

I'll have a LOT more thoughts on that in the next new issue going out to our Members in the next couple days as well as in a separate, dedicated commentary after that.

AND I'll also discuss upcoming the strange ways in which all the good that Trump, Elon Musk, et al have done over uncovering all the waste, grifting and more in the federal swamp may shortly be used against them in negotiations over the budget and spending bills that need to be agreed to in the next four weeks.

Even more so than the subject of tariffs, a near-"No Win" setup for Trump is going to force some hard decisions; and further reckoning for the markets.

And unlike the tariff decisions, the budget ones can't be put off.

(NOTE: I'll also have numerous sector and company updates in the upcoming new issue, including names added now to my "double down" list.)

All the best,

Chris Temple

Editor/Publisher

Sunday morning, February 16, 2025

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/