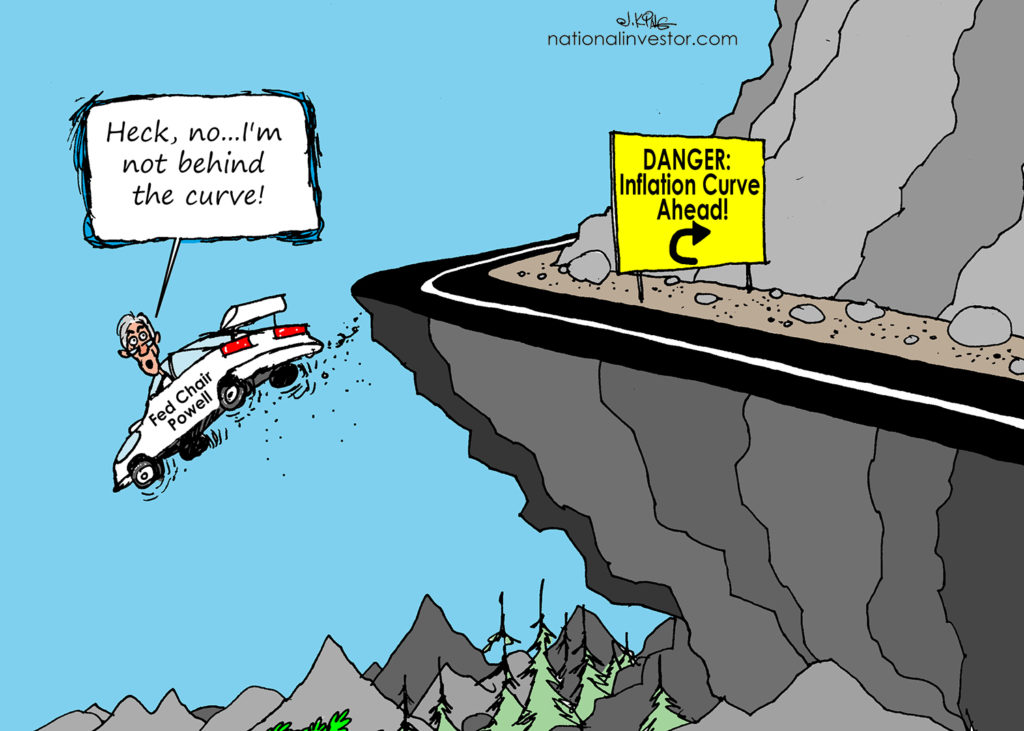

By Chris Temple – Editor/Publisher The National Investor https://www.nationalinvestor.com/ chris@nationalinvestor.com Sunday a.m. — Nov. 19, 2023 The present monetary tightening cycle which now seems to be nearing its end (as far as rate hikes by Fire Marshall Jay…