Good morning Investors! Fed Chairman Jerome Powell and his merry band somewhat surprised markets following their most recent policy-setting meeting on September 18, cutting the official short-term (federal funds) rate by 50 basis points rather than 25.

Some took this as a sign that the U.S. central bank is worried that, under the surface, the American economy is weakening more than commonly believed by investors (it is, by the way!) But for the most part—and for now—such worries are secondary to the primal knee-jerk instinct to BUY, BUY, BUY! most everything with an “easing” Fed.

The Prospector News' Mike Fox and I recently discussed all this as we always do post-F.O.M.C. and provided numerous thoughts as to what this initial half-percentage point rate cut means (and doesn’t). You need to listen to this recording RIGHT HERE; much of what follows will be based on our mutual observations and the evolving landscape.

Likewise, as most of you have already seen, I have been and will be continuing to provide a “road map” of sorts to our audience at The National Investor for how to navigate markets given not only the Fed but numerous other macro and geopolitical facts of life, many of those unprecedented. Here too, I’ll be further unpacking a lot of the fairly quick takes below on various commodity sectors in the weeks ahead.

In short—and notwithstanding the initial, post-rate cut bounces for most everything, save for long-term Treasury securities (the reasons for that and for long-term yields to inexorably move HIGHER are discussed in the above-linked podcast)—it’s not necessarily going to be a one size fits all melt-up for commodities from here. As Mike and I discussed in our podcast, the underlying economy faces further and broadening weakness in the quarters immediately ahead. And even if that does not lead to a deep recession, various trade, policy, currency and other challenges we discussed are going to result in very disparate behaviors among commodities (for present purposes we’ll be sticking with energy and metals/critical materials.)

___________________________

The most obvious winner among precious metals and otherwise is going to continue to be gold. Except for the relatively minor example of Japan, every major central bank in the world is now in “recalibration” mode—now finally joined by the Fed—if not outright panic money-printing in the case of China as that country attempts to forestall full-on deflation (NOTE: More on the very latest from China further along.)

Gold wins in that environment hands-down; so, too, as everyone continues to run gargantuan budget deficits that will only rise in recession.

Though almost all of gold’s rise to present record levels north of US$2,600/ounce came about without much participation from “western” investors, that seems to have started changing. And that in turn argues that the best and most explosive days of the renewed gold market are still ahead of us. Net buying has finally been enjoyed by gold-oriented ETFs over the last couple months or so.

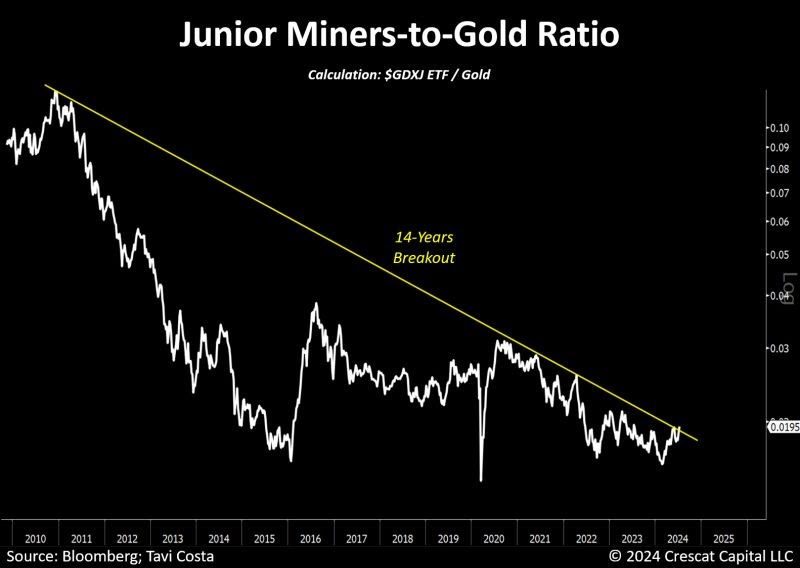

And there are signs that long-suffering gold-related equities are set to enjoy broader health; they have infamously been woeful laggards despite gold’s own move. As you see just below, their bottoming process versus the gold price appears to have concluded and an upturn started.

But even here, a little care must be taken. Keep in mind that without a significant further rally in the gold price itself, gold-related equities, generally speaking, may not prove completely impervious to a long-overdue correction in the broader stock market. Make no mistake: I am uber-bullish long-term. But it’s not clear sailing quite yet.

Also, bear in mind the market perceptions if I am correct (again, Mike and I spoke of this) in that 1. Longer-term yields begin rising anew and 2. That and/or additional factors slow down the pace of Fed rate cuts into next year. That will take some of the starch out of even gold, quite possibly; and certainly gold-related equities.

Moving on, silver has also been infamous in its inability to keep pace with its more monetary-oriented sibling. As I am writing this, silver—seemingly ready to break above its prior 2024 high just a few days back—has instead been nastily rebuffed the beginning of the week of September 23, in sympathy with other precious and base metals’ renewed weakness. So I guess the silver breakout many have been pining for will still have to wait a spell. Here too, though, I think time will show that silver will be dragged higher with gold, even if the “industrial” case is still being tarnished somewhat by both economic and policy uncertainties.

Platinum and palladium have been basket cases. Weak demand and trade issues have pushed each to under US$1,000/ounce. The recent announcement by Sibanye-Stillwater that it is shuttering its money-losing Stillwater West Mine in Montana serves as a poster child for a LOT of things: from the inability of western mines to compete head-to-head with lower cost foreign production, to policy mistakes by the U.S., to economic uncertainty and more.

As is being discussed elsewhere, there is now talk of some effort to “protect” U.S. sources like Stillwater West from foreign “dumping.” Montana’s Senators— Republican Steve Daines and Democrat Jon Tester, above—are seeking to ban Russian palladium imports especially.

PGM’s are cheap long-term; but they are not going to be getting any help from Fed rate cuts, as there are deeper issues involved.

Moving on, copper epitomizes the plight of the PGMs and most other industrial, critical metals more broadly. In its case—as opposed to the mixed picture for the PGM’s—copper’s well-known longer-term fundamentals are solid. Well beyond increased demand from new “green” energy industries and products, broader infrastructure and other demands the world over are set to undergird demand for the red metal that will well exceed present or contemplated supply.

It was that epiphany of copper’s bona fides that helped drive it to a nominal all-time high well over US$5.00/pound in the late spring. But almost as quickly the rally fell apart due to fears of coming global weakness generally and China’s economic downturn specifically; and this despite optimism that a Fed rate cutting gambit was dead ahead.

Now—notwithstanding its own knee-jerk rally on the Fed cutting by 50 bps rather than 25—copper is going to be hostage for a while to economic expectations and the pace of the Fed’s “recalibration.”

Much the same is going to be true, too, where most other metals/minerals are concerned. The Fed taking interest rates a bit lower to a more “neutral” area is not going to be enough to overcome policy mistakes (especially where Electric Vehicles and their inputs are concerned), continued inability to compete with cheaper foreign production, etc. So in many of these areas we need to pick our spots company-by-company; and otherwise, bide our time until 2025 gets here and 1. We know how bad a recession is going to be (or not) and 2. We know what the political makeup of the U.S. government especially is going to mean for the metals specifically and economic/industrial policy generally.

I’ll be following and commenting on all this in the weeks and months ahead, of course, as there will be many moving objects and some potential policy surprises. Even recently—though I don’t see anything being done before the election—the Biden Administration has interestingly floated the idea of subsidies for U.S. metals/mine production as a first matter (this as opposed to subsidizing the cost of an E.V. itself.) The next Administration will have a host of decisions to make!

There are, of course, some unique and even “one-off” individual commodity stories so strong/unique that they are attractive no matter what the Fed/economic outcomes. Think barite…titanium…tungsten…some rare earth elements…antimony…helium…and others.

And lest I forget, uranium for reasons I am explaining separately these days, after consolidating its prior monstrous gains this year, is set soon to embark on the next big leg of its own bull market.

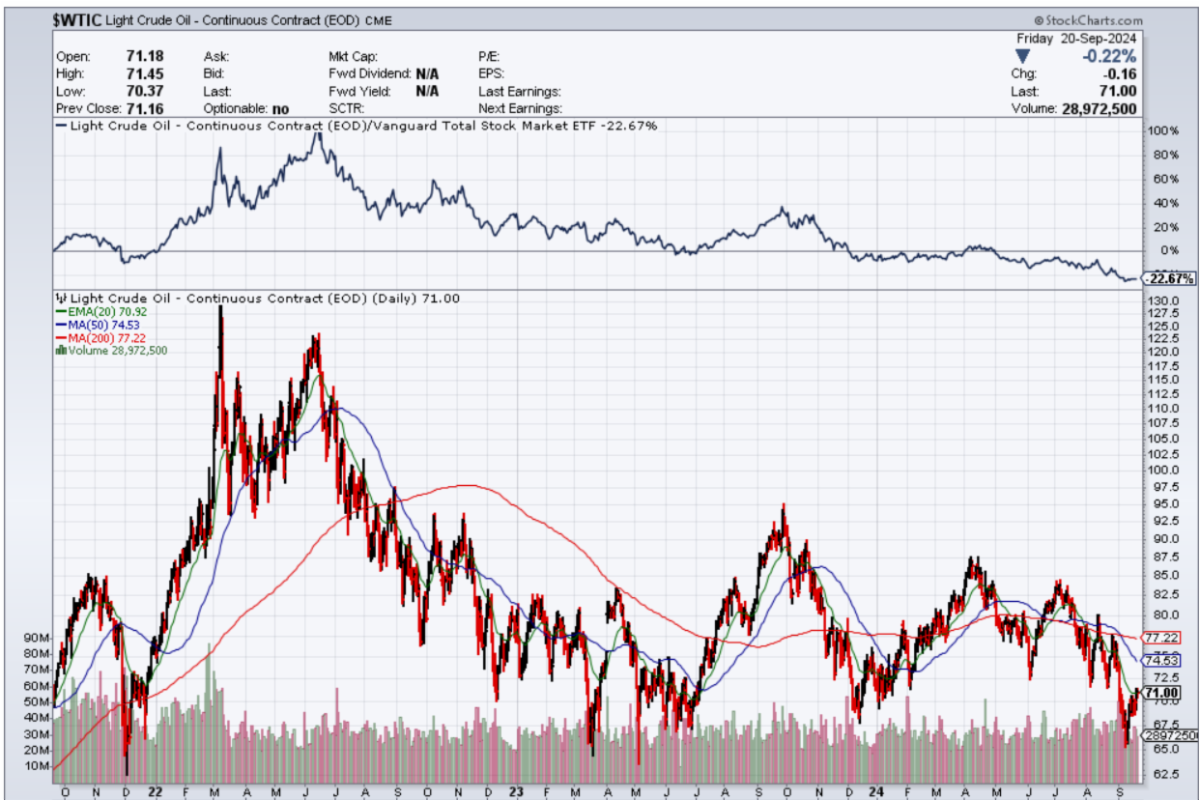

Finally, “old energy” is somewhat of a mixed bag, with Yours truly overwhelmingly favoring natural gas over crude oil right now. Here again—as you see above—crude received a little relief following the Fed’s rate cut. Yet sentiment has turned bearish in recent months (a significant overreaction as I presently see it) due to China’s present economic malaise and worries that America will slowly join in the funk. To be sure, supply/demand stats of late do not support the level of bearishness that has caused oil to bounce down to multi-year lows that haven’t been seen since the worst days of the COVID Plannedemic. But here we are none the less.

Natural gas has already bottomed and, in my view, is set for several months of a “recalibration” itself for a host of reasons. Here, too, the Fed’s rate cutting trajectory will not be the main story: resetting the natural gas price to a more realistic level will be.

– LATE BREAKING NEWS –

Overnight last night and into this morning, news came of a much more massive stimulus gambit on the part of China.

Something had been rumored for several days; what markets have now been greeted with are several borderline panic moves as the country’s leaders attempt to arrest the “Japanification” process China has been devolving into; one I have discussed several times in the recent past.

Among the measures:

-- Official policy interest rates have again been cut, with the promise of more to come.

-- By fiat, some US$5 trillion worth of mortgages in China have had their contractual interest rates cut.

-- Second-home purchase rules have been eased, as (of all things) China’s leaders see that a way to “save” the globe-leading, debt-choked real estate sector is to again allow all manner of buying.

-- Banks’ reserve ratios have again been lowered, helping to ease the profit hits some will take due to lower mortgage rates.

-- Direct support for the moribund Chinese stock market was announced, together with a pledge that a “stabilization fund” for stocks is being “studied.” By the way, Japan did most all of this along the way, too, in their three-plus decades of deflation.

For present purposes, China’s move is now juicing commodity rallies further especially. We’ll know how durable this sentiment will be by watching yields on long-term Chinese debt, which just hit fresh record lows; see THIS COVERAGE as an example.

If markets really believe this broad set of “Inflate or Die” moves will work, the knee-jerk reaction higher in stocks and commodities will continue and long-term bond yields will reverse course and move higher. We've seen a bit of that latter, as Bloomberg reports in its story; it needs to continue, however.

Again, we’ll be all over this in the days ahead and advising our Members at The National Investor what moves to be making!

All the best,

Chris Temple

Editor/Publisher

Tuesday morning -- September 24, 2024

Don't forget that you can follow my thoughts, focus and all pretty much daily ! ! !

* On Twitter, at https://twitter.com/

* On Facebook at https://www.facebook.com/

* On Linked In at https://www.linkedin.com/

* On my You Tube channel, at https://www.youtube.com/c/